TESLASUIT marketing team has prepared a series of articles on smart clothing. This is the second part, revealing the main trends on the smart clothing market, in particular, the position among other wearables, shipments, submarkets and forecasts.

Previously, the article about smart clothing classification has been published. The next piece of content will be dedicated to challenges for smart clothing market. Follow our blog to learn more.

Value, share, shipments and CAGR

Smart clothing submarket is new, and it is still being formed.

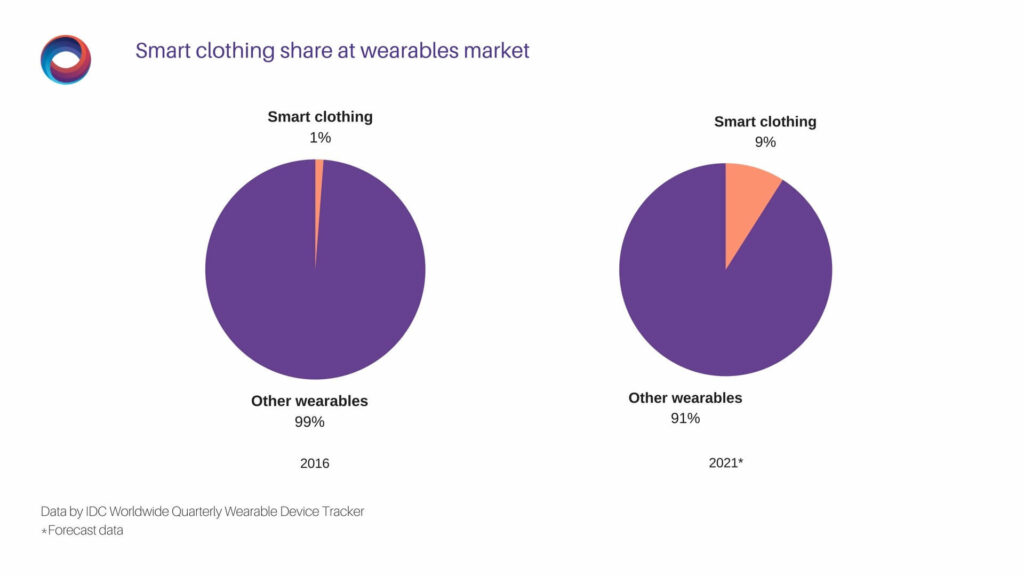

In 2016 garments took up just 1.3% of wearables market with 1.3 million devices shipped. As forecasted by IDC Mobile Device Trackers, smart garments’ share will grow up to 9.4% by 2021.

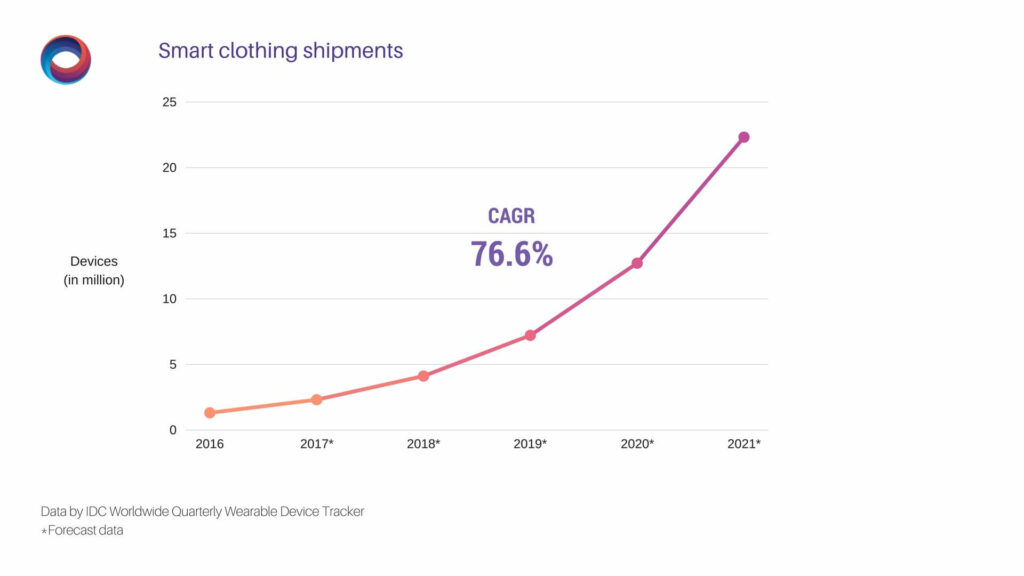

IDC Worldwide Quarterly Wearable Device Tracker also predicts that 22.3 million garments will be shipped in 2021. Tractica forecasts even 24.8 million devices shipped. The compound annual growth rate is expected to be approximately 76.6% from 2016 till 2021. It’s the highest CAGR at the wearables market.

There is a ground for such expectations. The main smart garments’ development trend is competition with fitness trackers. As it has already been mentioned, smart clothing have some advantages in comparison with wristbands. For example, smart fabrics can measure such indicators as muscle activity, stride rate and length, foot landing and so on. What’s more important, some garments allow to collect more accurate data than fitness trackers.

E-textiles market value is estimated to reach $5bn by 2027

IDTechEx Research

At the same time manufacturers of e-textiles, both fashion and fitness ones, started to cooperate with innovative technological companies. It is one more reason to expect smart clothing boom. Such partnership will let smart clothing be more comfortable, fashionable, functional and of higher performance.

One more promising area to adopt smart clothing is corporate uniform which is worn in such spheres as medicine, public safety, transportation, hospitality, education. Here smart clothing is used for сommunication between a particular specialist and a team to increase productivity.

Thus, smart clothing is a 2-sided marketplace, where consumers, who accumulate and process data, are in focus. Consequently, transnational companies are ready to pay for big data ensuring price reduction for garments until the demand and supply come closer to equilibrium.

Smart clothing market by application

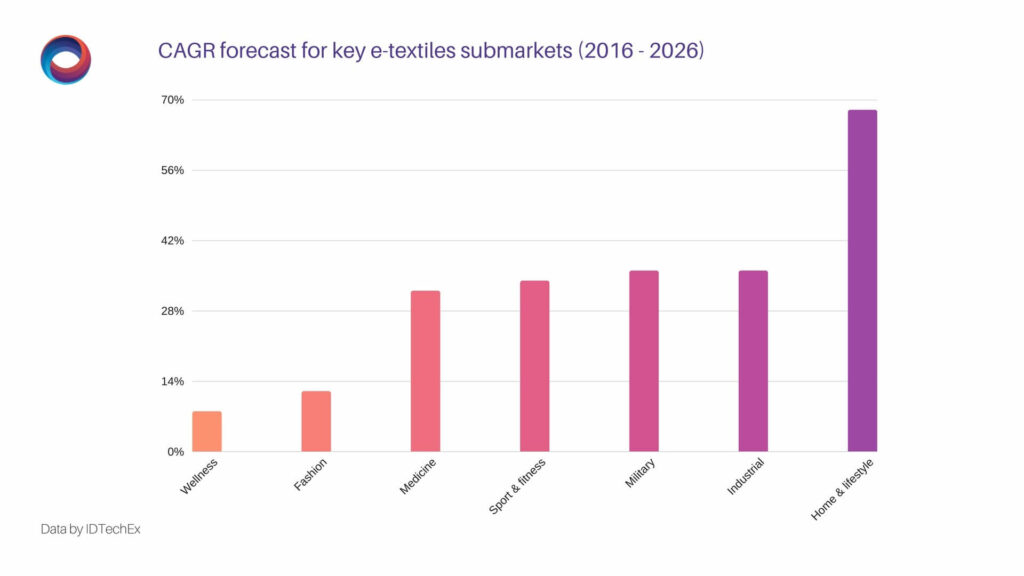

The global e-textiles market can be divided depending on applications. They are numerous, involving medicine & healthcare, home & lifestyle, sport & fitness, wellness, industrial, commercial & military, fashion, etc.

The highest compound annual growth rate is expected in home and lifestyle sector, approximately 70% from 2016 till 2026. But its market share will stay relatively small.

Military & industrial submarket has leading share among smart clothing now, but its predicted CAGR is not the highest on the market, about 36% from 2016 to 2026. This sphere marked the beginning of e-textiles market, as the mean to improve the efficiency and functionality. Particularly, e-textiles can help prevent injuries, detect wounds and monitor soldier’s health and level of stress.

Sport, fitness and also medicine will take dominant positions on the e-textiles market by 2026, and their CAGRs are forecasted to be a little bit more than 30%.

Smart clothing market by material type

Smart textiles market is changing fast, and the materials used are becoming increasingly complex.

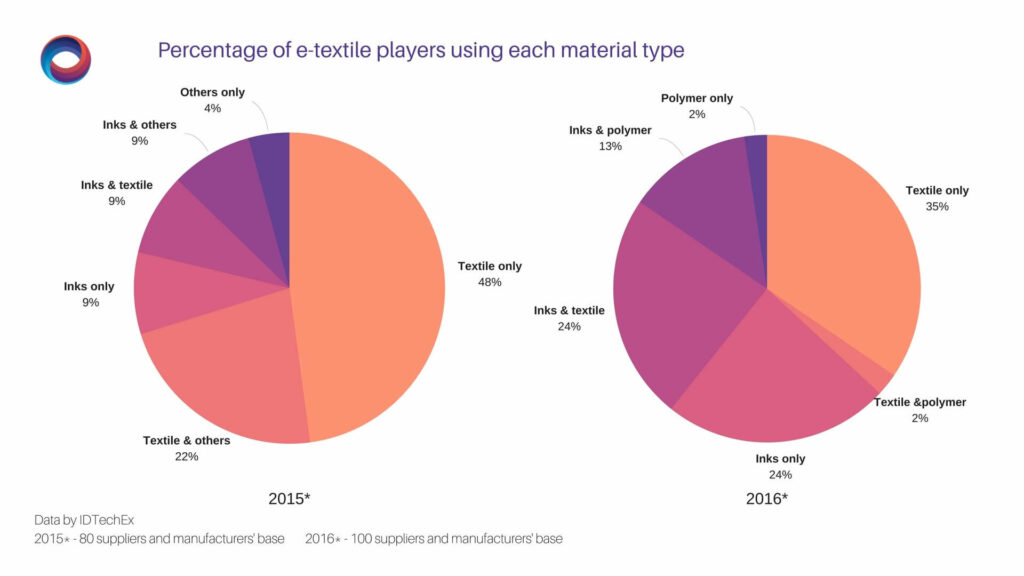

Fewer companies use textile only. Their share decreased from 48% in 2015 to 35% in 2016.

The quantity of suppliers and manufacturers adapting inks only, on the contrary, has grown 13% (from 9% in 2015 to 24% in 2016). If we talk about the share of companies that use both inks only and inks along with other materials, then growth of this submarket is impressive. In 2015 this share composed 27% and increased up to 61% in 2016.

Several years ago there were only several suppliers of stretchable conductive inks at the e-textiles market, such as DuPont and Nagase. But now inks are becoming more spread. Inks still compete with less expensive textiles, e. g., conductive yarns. So, ink-based e-textiles have great potential for growth.

Comparing the dynamics for the year, it’s possible to notice that material types have become more diverse. In particular, polymers have become an independent share of the e-textile market.

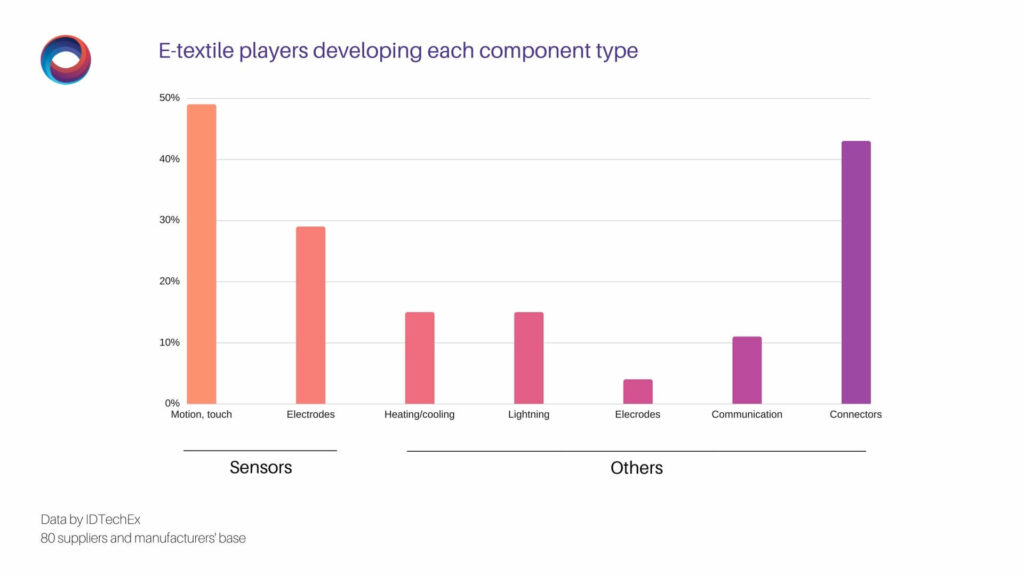

Components of e-textiles

One of the principal points in producing wearables is connecting textiles with electronics comprising power and processing. In general, such appliances are called components. The main components of smart clothing are sensors that collect information. The second place is taken by connectors.

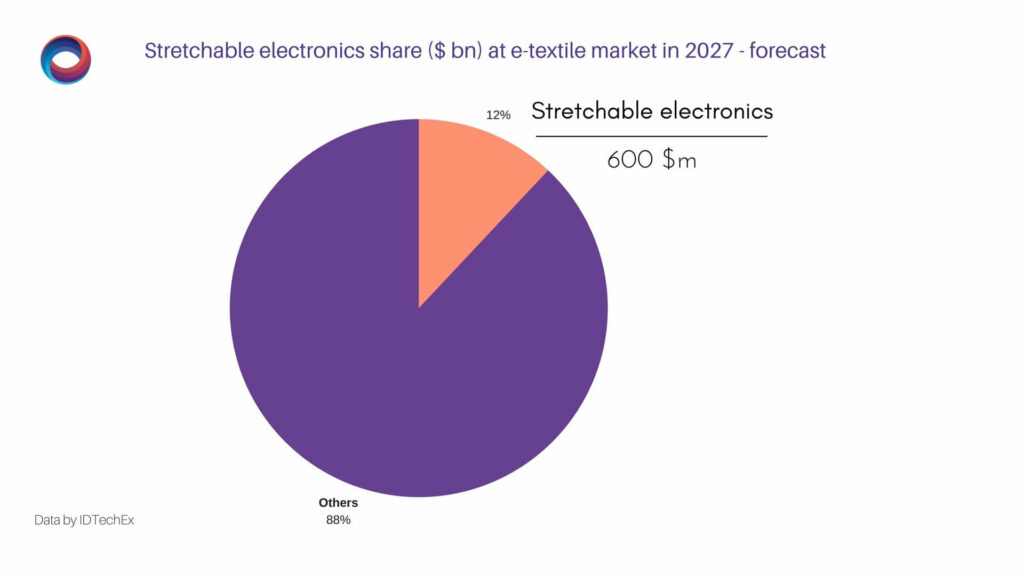

Stretchable electronics

Another landmark at the e-textiles market is about stretchable electronics. It is a technology of creating elastic circuits by enclosing stretchable electronic devices to stretchable substrates or implement them directly into stretchable fabrics.

Stretchable electronics has the following advantages:

- applicable in the spheres where fabrics’ deforming with the human body is needed;

- suitable for devices that are made in one size;

- improves the reliability of wearables subjected to strains.

As forecasted by IDTechEx, stretchable electronics’ market value will constitute $ 600 m in 2027. Considering that the agency forecasts total e-textiles market to reach $ 5 bn by 2027, the share of stretchable electronics is expected to comprise 12%.

It’s expected that e-textile garments with conductive inks and polymers will gain more popularity and сreating competition to other components, will reduce average prices.

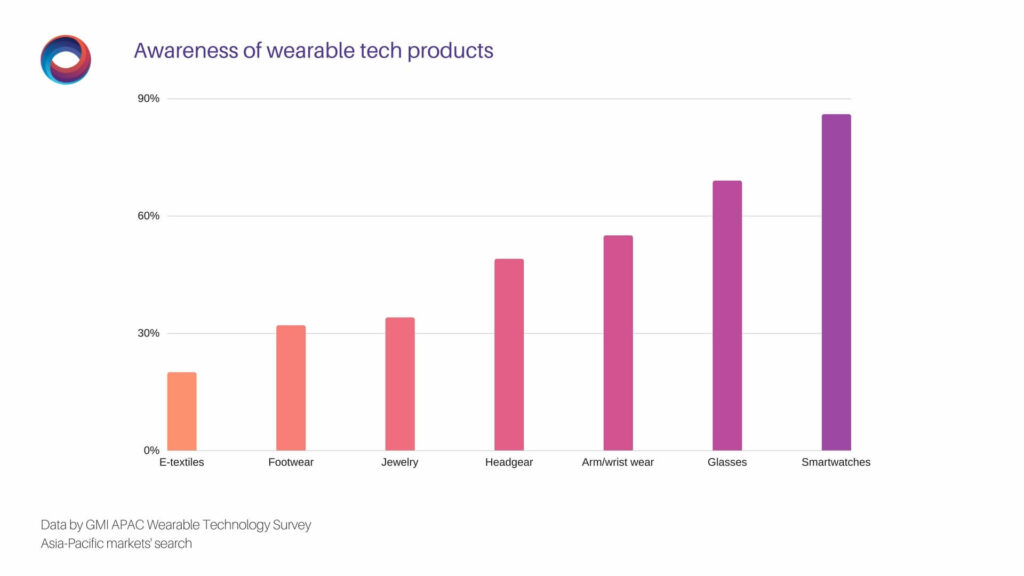

Awareness of e-textiles

As studies show, e-textiles, or smart clothing is not very popular. Basically, it’s due to the lack of public awareness of smart fabrics in comparison with other wearables. Only 20% of respondents said that they are aware of smart clothing. So, the e-textiles market will have great capacity very likely, especially seeing 77% compound annual growth till 2021.

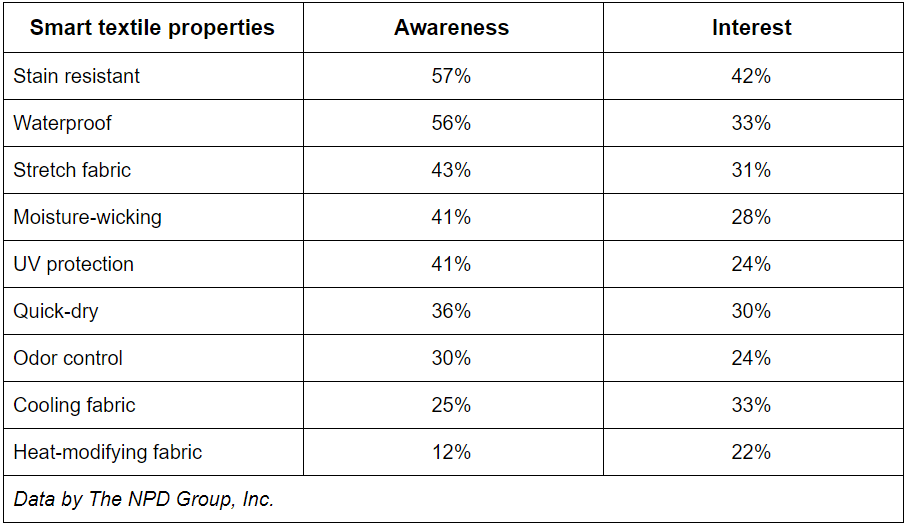

Smart clothing properties in demand

There are many features that smart clothing can have. According to the research of The NPD Group, more than half of respondents know about stain resistant and waterproof qualities of smart clothing. Also these categories of smart textiles are in the highest demand. Moisture-wicking, stretch and UV protection are familiar to approximately 40% of consumers. Only about 30% of people need them in smart clothing. Such functions as quick drying and odor control are known by 36% and 30% of purchasers, respectively. Surprisingly, heating properties of smart fabrics are known only by 25% and cooling is familiar to 12% of buyers. Wherein, interest to them is higher than awareness and comprise 33% anв 22%, respectively.

As claimed Marshal Cohen, chief industry analyst of the NPD Group, “smart fabrics are an important and innovative development for the fashion industry, but consumers don’t know enough about them to fully embrace them”. Also, he added that the industry needs to give the customer more information, with an emphasis on technology and performance behind smart textiles, advertising their advantages of using in everyday life.

It was a brief overview of smart clothing market. If you want to ask any specific details, please, feel free to contact us or comment below.

Follow our blog to learn more about smart clothing market and how to be successful producing e-textiles.